1. Foreword

From now until the time you finish this sentence, another 5,000 barrels of oil will have come out of the ground. Or 10,000 barrels by the end of this one, worth about a million dollars on world markets today. Suppose we created a World Oil Production Index (WOPI) as a measure of money, like a light year in distance. WOPI would equal a spacious Central Park apartment in a minute, the most expensive skyscraper ever built, Burj Khalifa, in a morning, and the net worth of Facebook's Mark Zuckerberg in two weeks.

Or, alternatively, WOPI would surpass the GDP of the Democratic Republic of Congo, a country of 70 million people, in a day and a half, and the entire annual aid budget to Africa in four days. It would, in fact, take about two weeks of WOPI each year to eliminate absolute poverty among the 1.3 billion people around the world who subsist on less than $1.25 a day each. It's not news of course that oil generates a lot of money. But it's good to get a handle on just how much.

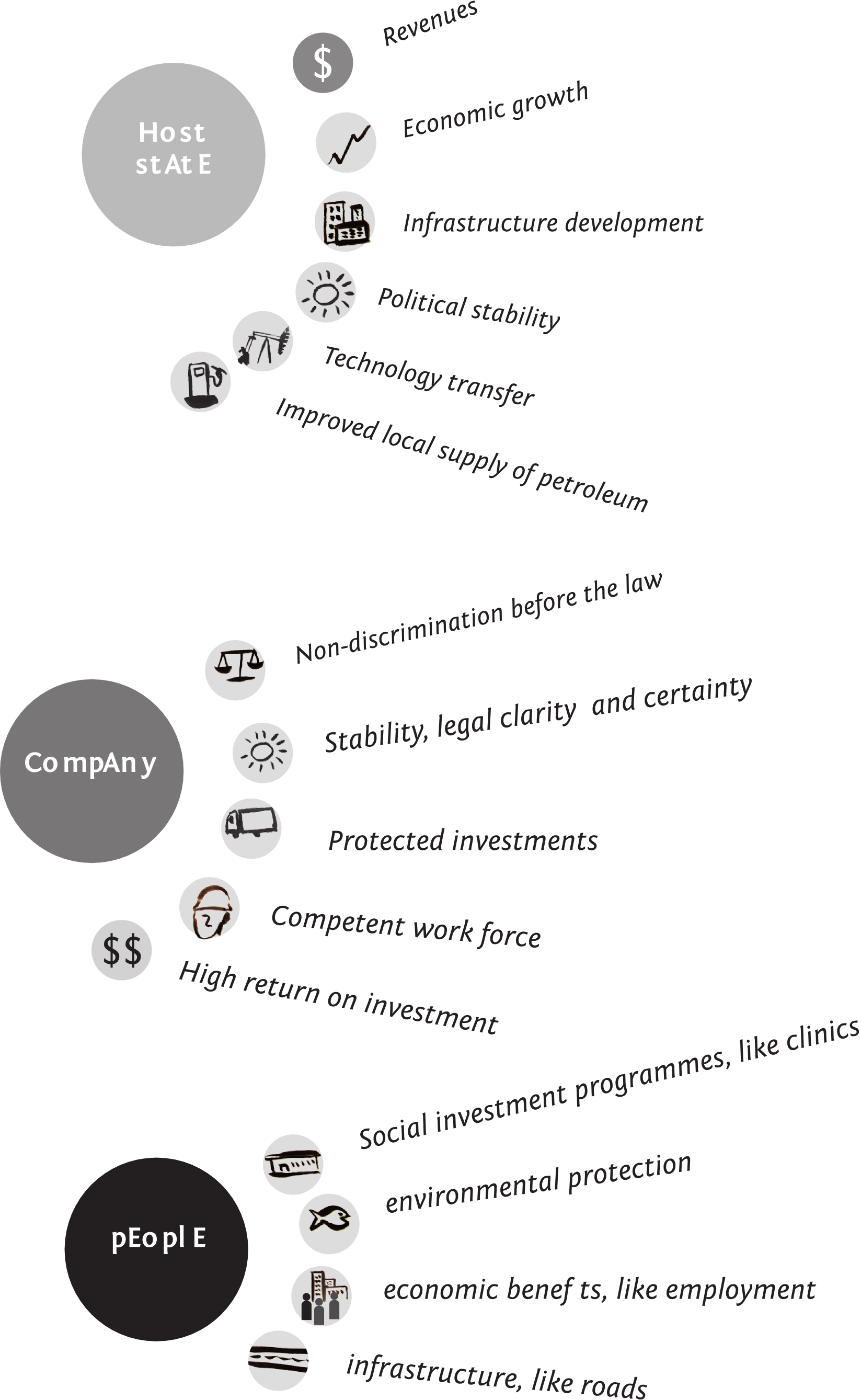

It is petroleum This is a footnote contracts that express how this money is split and who makes what profits, just as it is the contracts that determine who manages operations and how issues such as the environment, local economic development, and community rights are dealt with. The share price of ExxonMobil, the question of who carries responsibility for Deepwater Horizon, whether Uganda will be able to stop importing petrol, and how much it costs to heat and light homes in millions of homes -- these are issues which depend directly on clauses in the contracts signed between the governments of the world and the oil companies.

For most of the 150 years of oil production, these contracts have remained hidden, nested in a broader secrecy that surrounded all aspects of the industry. Governments claimed national security prerogatives, companies said commercial sensitivity precluded making them available.

But the last few years have seen the emergence of the the idea that these contracts are of such high public interest that they transcend normal considerations of confidentiality in business, and should be published. A few governments and companies have published contracts. Academic institutions such as the University of Dundee in the UK and NGOs such as the Revenue Watch Institute are just now, at the end of 2012, beginning to collect the contracts that are in the public domain into databases searchable over the Internet.

Contract transparency is the natural next stage of the transparency movement. The initiatives which began in the 1990s around 'Resource Curse', leading to the creation of the Extractive Industries Transparency Initiative in 2002, have succeded in opening up a public conversation. Governments and companies now acknowledge the importance of openness and ethical business. CSR was born to counter 'Blood Diamonds'. But there is as yet little systematic public understanding of how these titanic industries actually work. Activists and journalists sometimes penetrate dark corners and uncover kickbacks and secret deals, and occasionally trigger a public outcry that effects change. But public suspicion remains high around the world, fueled largely by this secrecy. In dozens of countries around the world public debate discussion continues with the main documents at the heart of this industry remaining absent.

Casual rhetoric about how "the government" or "the state" is being so secretive is not helpful because it misidentifies - and actually understates - the degree of dysfunctionality and asymmetry of information that can exist. This is often "deep state" stuff, belonging to a world of aides and special advisors with ill-defined roles, where the regular apparatus of the state can also be out of the loop. In one country, senior diplomats in its foreign ministry lack the most basic understanding of the industry that generates 90 percent of its revenues and governs relations with its neighbours, with whom it shares sizeable fields. In another, the finance minister himself has been denied access to the petroleum contracts which determine how much revenue he is supposed to collect from international oil companies and others. In a third country a bid round went bad, and contracts were delayed for two years, because a phone call to clarify basic details wasn't returned. Ministers of the economy, planning and environment are rarely consulted about how contracts can integrate into broader government policy.

And yet, because of the pioneering move to publish by some governments and companies, the chance now exists to begin to create public understanding of petroleum contracts, based on those that exist in the public domain. This book is a first attempt to rise to that opportunity. We aim to reach at least ten thousand people around the world who may be engaged in the industry, or in governance of or transparency activism around it, but who may not have had the chance to gain professional exposure to petroleum contracts and the issues of how they are actually negotiated. We hope they will include people in the public and private sectors of 50 countries, journalists and civil servants and local business communities as well as promoting a broader understanding of the negotiating process within the companies themselves.

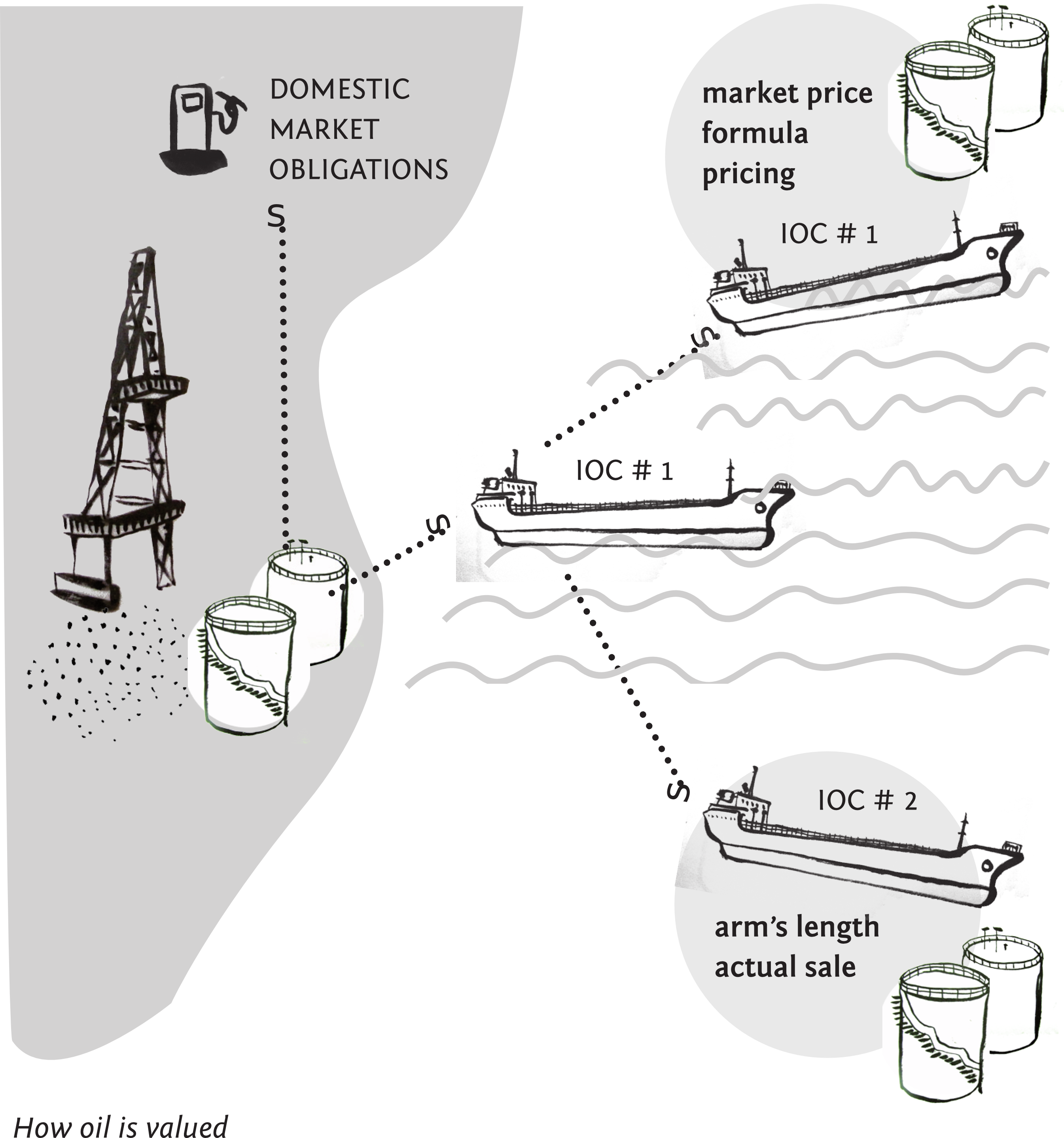

The sections of the book are intended to lead the non-specialist reader through a logical sequence in understanding contracts. Section One sets the stage with background context. Section Two, who the players are, establishes the formal parties to a petroleum contract and the normal provisions of who does what and who decides what according to the contract. Section Three, 'The Money', goes to the heart of the negotiation and deals with all the different revenue streams and tools that go into constructing ever more complex financial arrangements.

Then we devote two sections to subjects which are handled in contracts but often in passing and at the last minute. Section Four deals with the linkages between the petroleum industry and economic development as a whole in the producing country, as dealt with in the contract, while Section Five looks at clauses relating to health, safety and environmental protection. Finally, in Section Six, Lawyers Yammering On, we look at pure legal aspects, dispute and arbitration procedures.

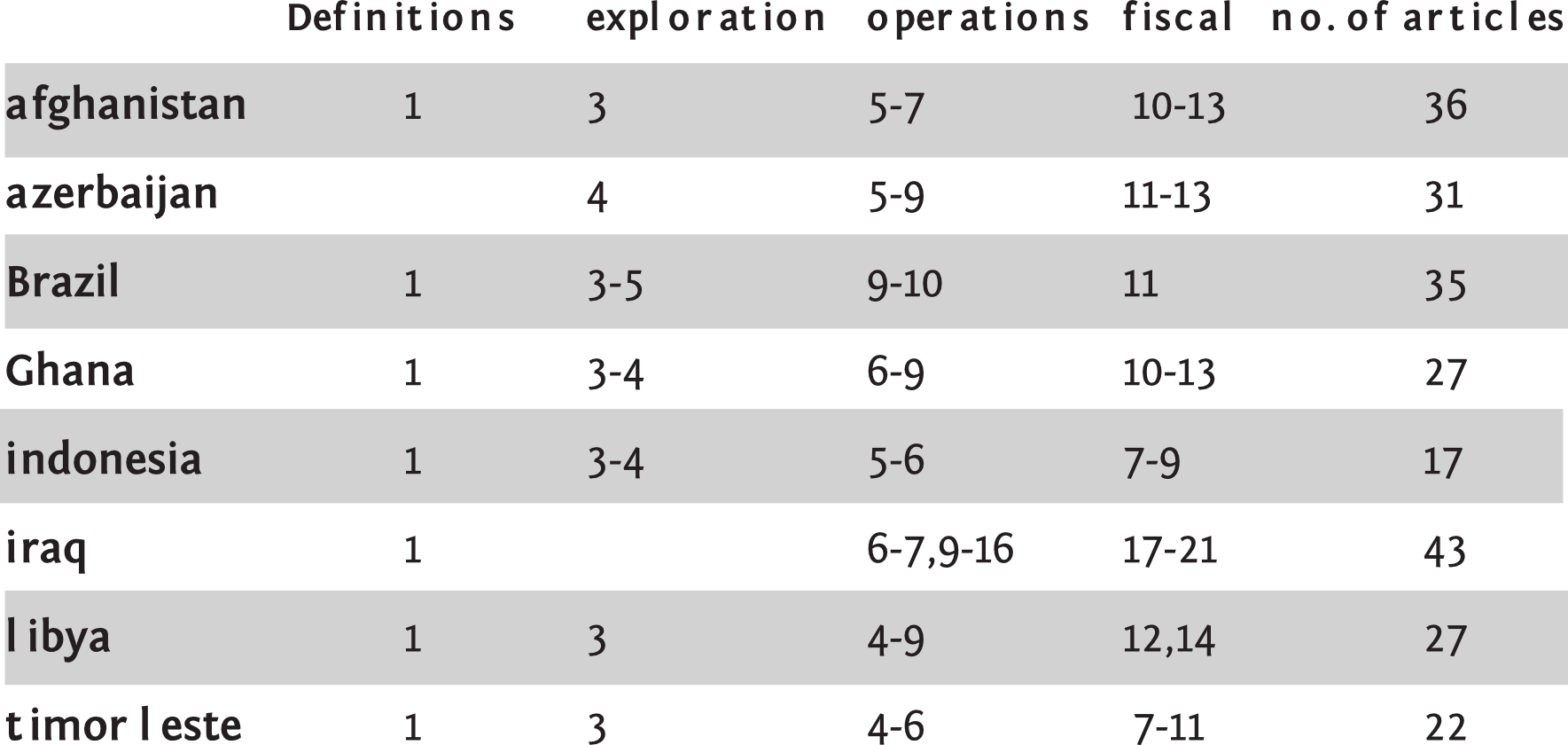

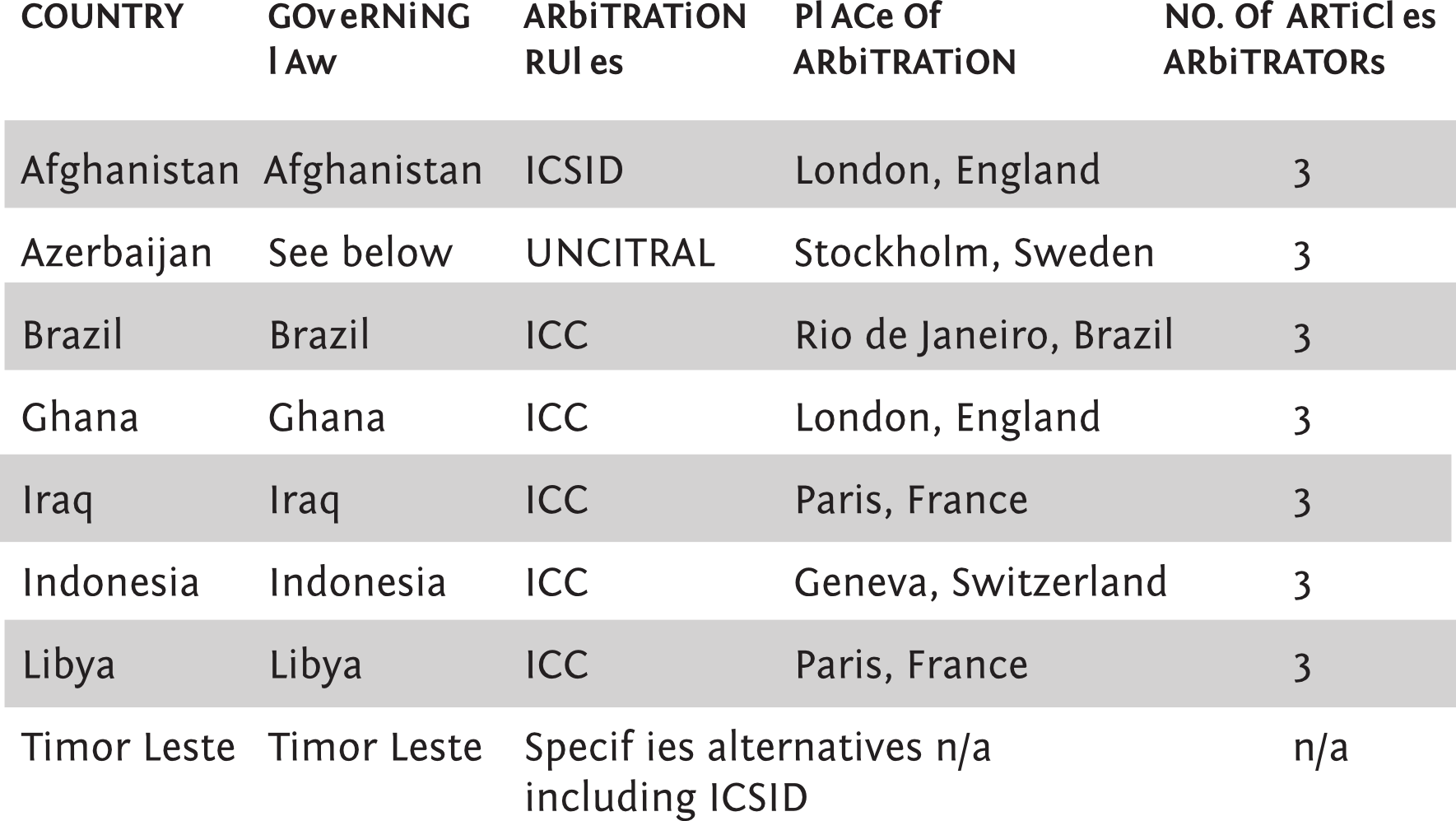

We quote liberally from a family of petroleum contracts throughout the book that come from eight countries - Afghanistan, Azerbaijan, Brazil, Ghana, Indonesia, Iraq, Libya and Timor Leste. They were selected to represent various structures in contracts, stages of development of petroleum industry and most of all because they are in the public domain. Other contracts are referred to from time to time.

This book has been written in five days from start to finish, using the Booksprint technique pioneered by Adam Hyde. I am writing this foreword as its last entry on a Friday afternoon at Schloss Neuhasen little more than 100 hours after we sat down to storyboard it. This is both a source of pride -- and our first and last defence when our colleagues and the broader community point out inaccuracies, gaps and other defects, as we hope they will and encourage them to do.

The Booksprint is a collaborative writing technique of astonishing power in which colleagues constantly brainstorm, write, edit and copy-edit each other in a workflow that somehow manages to combine high fluidity with structure. But inevitably in a process of such speed there will be uneveness and difference in tone and perhaps, at the margins, in substance, between one section and another. It is a work of collective authorship published under the Creative Commons license, but that does not mean that every one of us, or the affiliations we represent, subscribes to every statement made. This book is more team work than group think.

The writers of this book are: Peter Eigen, founder of Transparency International and founding chair of EITI; Cindy Kroon from the World Bank Institute; Herbert M'cleod from Sierra Leone; Susan Maples, Office of the Legal Adviser to Liberian President Ellen Johnson Sirleaf; Nurlan Mustafayev from the legal affairs department at SOCAR, Azerbaijan's state oil company; Jay Park, a lawyer from Norton Rose; Geoff Peters; Nadine Stiller from the German agency for international cooperation GIZ; Lynn Turyatemba from the NGO International Alert in Uganda; Johnny West, founder of the OpenOil consultancy; and Sebastian Winkler, Director Europe for Global Footprint Network. All work on the book was pro bono or mandated by the organisations we work for. If you want to hear each of us in our own words talking about the project, go to http://openoil.net/booksprint

Adam Hyde of SourceFabric (Booktype) and BookSprints.net facilitated the Book Sprint and Lynn Stewart designed the book and its art work. First readers, and copy editors were the OpenOil team of Steffi Heerwig, Robert Malies, Zara Rahman and Lucy Wallwork.

We received financial assistance to write this book from: Internews Europe, a media development organisation based in London; Petroleum Economist magazine (with no editorial input - our views and mistakes remain our own); and the German Federal Ministry for Economic Cooperation and Development (BMZ).

We want this book to be the start of a broader public conversation about petroleum contracts. It will be a living document, subject to constant critique on the Web and periodic review. Anyone can download it at any time, print and sell it, and adapt it. Please bear in mind, though, that because our work is Creative Commons license and available to everyone, the terms of copyright say that you inherit the terms of that license and any work you base on ours will legally be under Creative Commons license too.

We aim for the book to become the basis for localised versions which take a look at petroleum contracts country by country. There is no reason why, three years from now, there shouldn't be, for every country in the world with a petroleum industry (or hoping to develop one), an editorially independent and technically informed book put together by a group of sympathetic but objective professionals from a range of disciplines which analyses that country's core contracts, available to the public free of charge. We would be delighted to help make that happen with anyone in a producing country who has an interest.

We also aim to make it the basis for training courses, ported to all relevant locations and languages, which bring a fundamental and holistic understanding of petroleum contracts to a much wider audience than has had the chance to engage with them so far.

It is our belief that even though these contracts were not written with the public in mind, with a little effort they can be understood to a level which enables real, mature and informed public discussion. We hope that after reading this book you will agree.

Johnny West

Founder OpenOil.net

2. Petroleum Basics

You put it in your car. It heats your house. Flies planes. One day we might be beyond it, but today we are not. Petroleum. The material behind these critical functions that literally fuel the world, is made up of strings of carbon and hydrogen, known as hydrocarbons, formed from the compression of organic matter over hundreds of millions of years. Old stuff that drives the modern age. Oil, gas, petrol, diesel, butane - they all come from hydrocarbons beneath the earth's surface that are then are refined to make them more useful to us. This book is about the contracts that make finding and producing these substances possible right now.

The first thing that will probably come into your mind when you think about products that could be made out of all that petroleum is probably fuel. However, there are numerous other materials and products that contains oil or gas, e.g. toothpaste, candles, medicines, or even computers. This also explains why currently petroleum is of utmost importance to our lives today.

Historically, petroleum contracts were designed with crude oil in mind, and this continues to dominate the logic and structure of contracts today. Gas has only recently also become a valuable resource. As the old industry saying went: "What is worse than not finding oil? Finding gas!" This is not true any more, as gas becomes increasingly marketable. But not all contracts around the world have, as yet, caught up to this reality.

Natural gas, or just gas, is usually classified within contracts as either non-associated gas and associated gas. Non-associated gas refers to gas reservoirs that contain only gas and no oil, whereas associated gas is found together with crude oil. The implications of these can be far reaching and will affect environmental, social, political, fiscal and technological considerations. Countries with significant gas deposits will typically address these considerations in far greater details in their contracts than countries with primarily crude oil reserves.

Offshore & Onshore Operations

Petroleum operations can be either onshore or offshore. Some countries have seperate contracts for onshore and offshore, whereas others treat them differently within the contract. In what might be one of the most straightforward terms used in this book, onshore operations refer to operations taking place on land, while offshore, or subsea, operations take place in the sea and through the seabed.

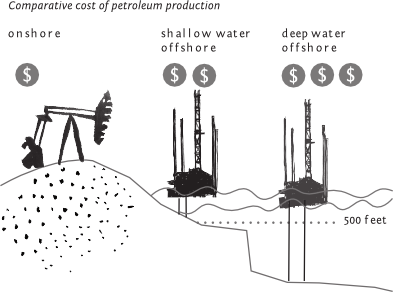

The following diagram shows the three types of petroleum extraction and their comparative costs.

Offshore operations are more expensive than offshore operations because of the type of facilities and structures required. Deep-water drilling is much more expensive than shallow-water drilling because the platforms are technically more difficult to construct. These considerations are addressed in contracts by providing financial incentives (e.g. tax reductions) for those operations and stages of production that are more challenging, riský and costly to the contractor.

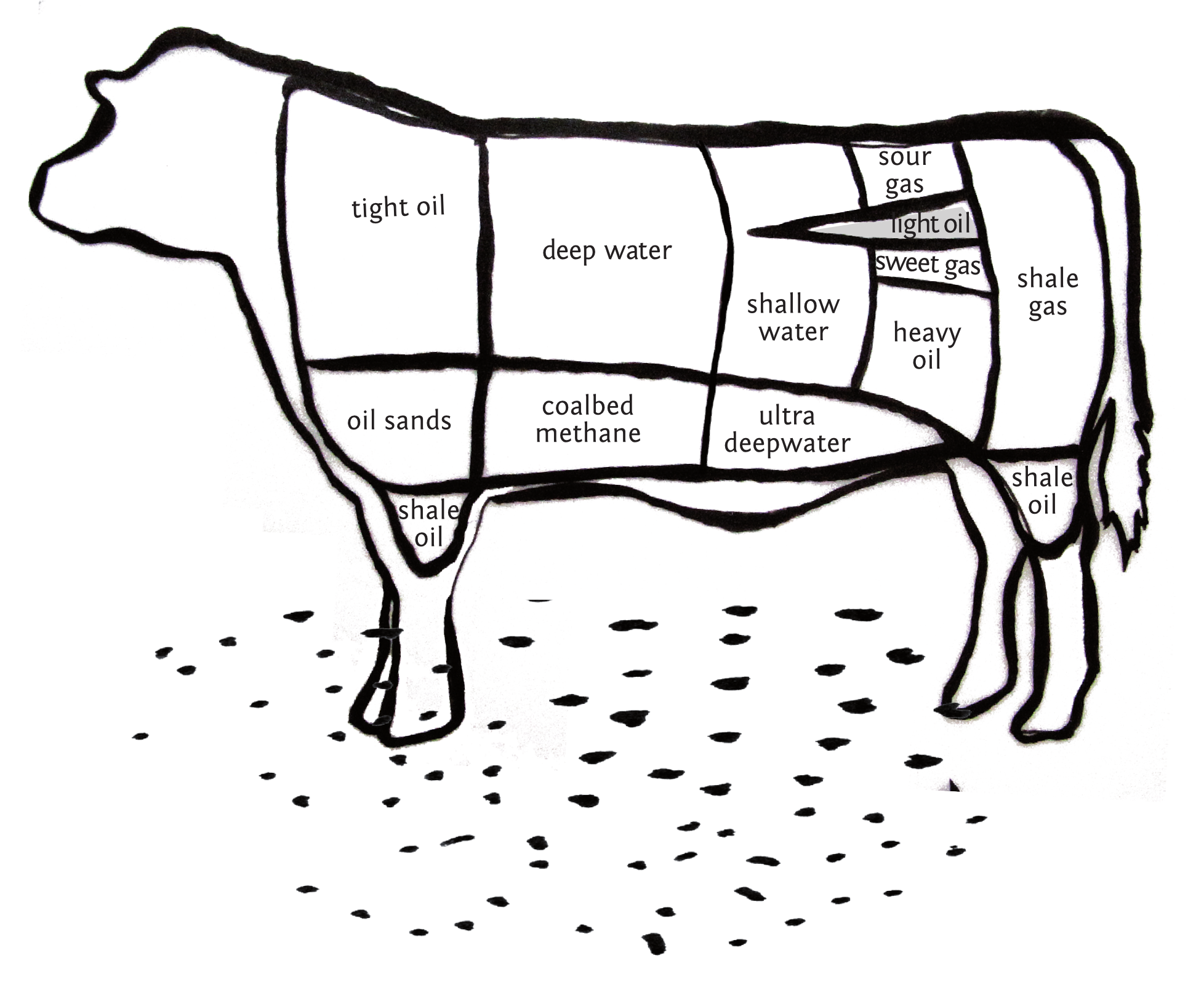

Conventional vs Unconventional

Flipping through the newspapers, you read about protesters upset about "unconventional" oil being developed on pristine farm land. Or France is considering banning it. But what is unconventional oil? For that matter, what is conventional oil? The distinction between conventional and unconventional operations refers to the manner, ease and cost associated with extracting the petroleum.

Conventional oil extraction employs traditional oil wells, and unconventional, the new and emerging technologies and methodologies allowing access to more inaccessible reserves, such as those found in oil shale and oil sands.

Conventional gas is typically “free gas” trapped in rock formations and is easier to extract. Unconventional gas reservoirs include tight gas, coal bed methane, gas hydrates, and shale gas (which sits in sand beds). Drilling for unconventional gas can be more expensive compared to conventional gas. The supply of and interest in gas extracted from unconventional reservoirs is growing rapidly, mainly due to technological advances.

....but as of the writing of this book, most contracts do not provide for the unique attributes of unconventional gas.

The Price of Petroleum

The price of petroleum is another headline grabber. We all know it is out there, but we probably do not stop to think about the details too terribly often.

What does "Oil is at $100 a barrell mean"? All oil? Some oil? The answer to this is, "some oil".

Petroleum is being bought and sold at many different prices all over the world though they tend to be compared or "benchmarked" off certain common standards.

- For Oil, West Texas Intermediate (WTI) or Brent crudes or blends and commonly used.

- For Gas, Henry Hubb is common.

These benchmarks, which are the prices that make the headlines, are used to determine the price of oil and gas produced elsewhere. This will be discussed in more detail later in the "Valuing Oil" chapter.

Future Pricing

A critical and heavily debated question is what will the future price of petroleum be? Unfortunately, there is no single or easy answer to this question. What drives oil prices is a subject of much debate about; global oil consumption, economic growth patterns, technological innovation, and political dynamics in oil producing countries. This is not the subject of this book, however, and will be something we'll leave to the experts.

Future Trends in contracts

The price of oil has, historically, driven fundamental shifts in the oil business and the contracts that underpin it. In late 1960s and 1970s, the famous first wave of nationalisation of natural resources led to the creation of a new form of contract - The Production Sharing Contract.

Nowadays, with the price of oil being high, there is an increasing movement of people in resource-rich countries wanting visual proof that their natural resources are directly benefiting them. From their position as citizens of the country and therefore as co-owners of the resource, there is a call for re-negotiation of contracts and the formation of new contracts that address this.

What does all of this mean for oil contracts, the subject of this book?

Who knows, is the short answer. It would seem to suggest that the search for petroleum will continue, at least in the short term, with developing extraction technologies. Maybe this will produce a flurry of new oil contracts between companies and governments that address these new methods of extraction. But they might not.

The oldest contracts, from the days of Edwin Drake in Pennslyvania back in 1859, did not look terribly different, at the most fundamental level, than many of the contracts today. Is it time to race forward? Keep what we have got? A combination of the two?

We do not claim to know and it probably depends on who you're asking, but we do hope that this book enables you to engage in such a discussion and ask questions that could lead you to an answer. The contracts and laws in the petroleum sector are often reformed for various policy reasons and this book is designed to help the reader actively engage in this process.

3. The Life & Times of a Petroleum Project

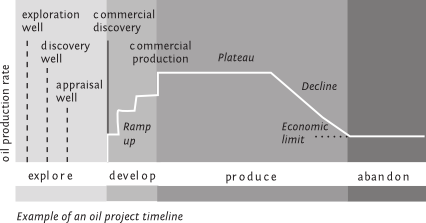

Petroleum doesn't last forever. It is a non-renewable resource. This fundamentally drives the business decisions of companies, a key part of which is that most petroleum contracts are structured to contemplate the entire life span of a project, it's beginning, middle, and end. The key stages of a project's life (or "petroleum operations") are:

- explore to find it in the first place;

- develop the infrastructure to get it out;

- produce (and sell) the petroleum you've found;

- abandon when it runs out and clean up ("decommission")

Each of these stages is broken down and discussed in detail below.

Explore

Petroleum is rarely found on the surface of the earth. One is very unlikely (though would be quite lucky) to step into a puddle of oil, though when this does occur it is known as a "seep" which means what one would think it means: oil below the ground has "crept up" from below the surface to "seep out" onto the surface. In the early years of oil discovery, seeps were probably one of the best means to find oil and gas. And oil still does seep to the surface of the earth in many locations across the globe. But a seep does not mean an oil boom. Nowadays, we use much more scientific and data-intensive means of finding petroleum beneath the surface of the earth.

Seismic

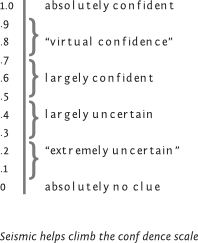

Today, geological surveying methods known as seismic studies (or just "seismic") are usually the starting point of any oil exploration effort. The essence of seismic studies are to use sound waves, shot down into the earth, to 'see' what is underground. Although it is often said that one cannot be certain that petroleum is in a given location until a exploration well is drilled, taking seismic surveys help increase one's confidence that drilling - an expensive endeavour - in a particular location is worthwhile. In other words, seismic helps climb the 'confidence scale'.

Commonly found beneath the earth's surface are various types of rocks, water and salt, all of which react differently when hit with a sound wave. Large amounts of data are captured from this process and used to give an image of what lies beneath the earth's surface.

As computer technology has improved, seismic has been able to handle increasingly large quantities and complexity of data, though the cost of gathering and interpreting this incures increasing costs. This is why you will see in some contracts the type of seismic required (eg. 2D vs 3D), how many kilometers of seismic is to be gathered ("shot" in industry jargon) and specifically that it must be interpreted and the results provided to the host government.

EXCERPT from Timor-Leste JPDA S-06-01:

4.1 - In each Contract Year mentioned below, the Contractors shall carry out an Exploration Work Programme and Budget of not less than the amount of work specified for that Contract Year:

Contact Year 1: Acquisition, processing and interpretation of 1150km 2D seismic data

Exploration Drilling

If the seismic produces promising results - sometimes called a "lead" - then the next phase of exploration will typically be drilling an exploration well. Here, an extraordinarily large drill bit is cut into the earth's surface in order to bring up a "core" or a cylindrical sample of that portion of the earth.

EXCERPT from Ghana Petroleum Agreement with Tullow, Kosmos, and Sabre March 10, 2006:

"Exploration" or "Exploration Operations" means the search for Petroleum by geological, geophysical and other methods and the drilling of Exploration Well(s) and includes any activity in connection therewith or in preparation thereof and any relevant process and appraisal work, including technical and economic feasibliity studies, that may be carried out to determine whether a Discovery of Petroleum constitutes a Commercial Discovery

Even with conducting seismic to help climb the confidence scale, one might need to drill several exploration wells to establish what is in fact below the earth's surface. One commonly used comparison to exploration drilling (particularly in the deep offshore) is trying to stick an extremely long straw in a drinking bottle from the top of a skyscraper and then drink from it. Of course, there are many areas where hydrocarbons are known to exist, though they might not be evenly distributed. In these cases seismic is still needed to increase the chances of 'hitting the target'.

Because most of us use fuel in our cars which we see as a liquid, many of us envision petroleum to be in lake-like pools below the earth's surface. In fact, it is found in spaces or cracks within rock formations and needs various techniques to extract (relieve pressure, create pressure, etc). One might picture a glass with a lot of crushed ice and trying to drink a milkshake from it.

While there is no standard amount of time one might conduct seismic studies and drill exploration wells in the world, these studies and drilling and the interpretation of the results even on a very rapid schedule takes months at the very lesat and more often around 2-4 years.

Discover and Appraise

Let us assume that, lucky you, you found hydrocarbons while drilling; you have "discovered" petroleum! Is the pay day coming? Most likely, not quite yet. You may have "discovered" hydrocarbons, but the question then becomes, how much did you find? Enough to make it worthwhile, "commercially viable" or economical to develop and produce? What you will need to do next: "appraise" the discovery.

Appraising entails more drilling and seismic to asses what you have discovered, but to a greater degree of accuracy. It will lead to more detailed geological discovery while also involving assessment and reflection on how to build the necessary infrastructure to produce the petroleum you've found. You will want to know more about:

- the chemical composition of the various hydrocarbon deposits

- the quantity of reserves in the area

- how to get these hydrocarbons out of the ground (if the discovery is found to be of commercial signficance)

Excerpt from Ghana Petroleum Agreement with Tullow, Kosmos, and Sabre March 10, 2006:

"Discovery" means finding during Exploration Operations an accumulation of Petroleum not previously known or proven to have existed, which is recovered or recoverable at the surface in a flow measurable by conventional petroleum industry testing methods;

"Appraisal Programme" means a programme carried out for the purposes of delineating the accumulation of Petroleum to which that Discovery relates in terms of thickness and lateral extent and estimating the quantity of recoverable Petroleum therein;

Commerical Discovery or not?

Once hydrocarbons have been found in sufficient quantities and with an economically viable extraction cost, the discovery becomes a "commercial discovery". It is important to stress here that a commercial discovery is not a geologic term but a business term. For this reason, the length of time an appraisal takes will likely depend on such considerations as:

- the business considerations of the company that has found the oil

- the local laws and regulations that determine the process of development

EXCERPT from Timor-Leste JPDA S-06-01:

"Commercial Discovery means a discovery of Petroleum that a Contractor declares commercial as contemplated in Section 4.10;

Develop

Once you have explored, discovered and appraised a petroleum deposit and determined that it is worth the cost to get it out of the ground, the next stage is to develop infrastructure to extract it. Depending on a number of factors, including geology, location and local regulations, you will need to determine the best way to get your hydrocarbons out of the ground and to the market.

This can include decisions about how many wells to drill (yes, there can be more than one, there can be many!), what type of platform you will be building or whether to build a platform at all. Increasingly, offshore oil developments are using boat-like structures to extract petroleum, the Floating Production, Storage and Offloading units or "FPSOs" in short, or different varieties (eg. FPOs, or FPS's) which do only some of these functions.

The development phase is rarely less than several years. Engineering, community and business considerations, among others, all factor into the type and scale of infrastructure that will be used to extract the petroleum. This is the phase which requires the most amount of money in the life cycle (the most "capital intensive"). While exploration well drilling in the offshore might get into the hundreds of millions of dollars, complex, large-scale difficult environments for the extraction of petroleum can hit tens of billions!

Produce

At long last - perhaps a decade after the start of exploration - oil or gas will finally flow. As various wells come 'online', petroleum will flow in increasing quantities as production "ramps up". At some point, once most of the first major development has been completed, tested, and refined for any bugs in the system, there will be "commercial production". This occurs when the petroleum is finally flowing at the expected rate over a period of a month or so. How long will production last? This is affected by many factors, but probably most significantly by the size of the find.

EXCERPT from Ghana Petroleum Agreement with Tullow, Kosmos, and Sabre March 10, 2006:

"Date of Commencement of Commercial Production" means in respect of each Development and Production Area, the date on which production of petroleum under a programme of regular production, lifting and sale commences;

EXCERPT from Timor-Leste JPDA S-06-01:

"Commercial Production" occurs on the first day of the first period of thirty (30) consecutive days during which production is not less than the level of regular production delivered for sale determined by the Ministry as part of the approval of, or amendment to, a Development Plan, averaged over no less than twenty-five (25) days in the period;

Abandon

After anywhere from around seven years of production from smaller areas to fifty years or more from the giants, it is time to take all of the "steel and metal" down, plug the production wells and restore the environment to its original state. A common alternative to this is where the contractor turns the assets over to the state so that it can then continue operations and eventually abondoning themselves at a later time. These processes are generally referred to as "Decommissioning" or "Abandonment".

EXCERPT from Timor-Leste JPDA S-06-01:

"Decommission" means, in respect of the Contract Area or part of it, as the case may be, to abandon, decommission, transfer, remove and/or dispose of structures, faciltiies, installations, equipment and other property, and other works, used in Petroleum Operations in the area, to clean up the area and make it good and safe, and to protect the environment

It is important to note that significant amounts of petroleum will likely remain in the ground at this point. This may be because the financial system in place in the country makes continued production uneconomic and/or technologically there does not continue to be cost-effective means of producing petroleum. The environmental issues related to abandonment are discussed in the section: Environmental, Social and Health & Safety Issues, while project economics and their impact on production are discussed in the section: 'The Money'.

Other factors that may cause a contractor to halt or even indefinitely cease operations, may not, however, trigger the contractual obligation to decommision. These could include security concerns, social unrest or political instability. These 'force majeure' events would not terminate the contract, but could suspend the contractors obligation until operations were able to resume.

4. What is a Petroleum Contract?

Experts estimate that for a large natural resouce extraction project, there will be well over 100 contracts to build, operate, and finance it - all of which could fall under the broad category of 'petroleum contract'. There may also be well over a 100 parties involved, including:

- governments and their national oil companies (NOCs), e.g. Gazprom, Petronas

- international oil companies (IOCs), e.g. BP, Exxon, Chevron, CNOOC

- private banks and public lenders, e.g. JP Morgan, World Bank

- engineering firms, drilling companies & rig operators, e.g. Halliburton, Schlumberger, Technip

- transportation, refining and trading companies, e.g. Hess, Glencore, Trafigura, Koch Industries

- ...and many more

Among these many contracts, the most important is the one between the government and the IOC and it is this conract that will be addressed in this book. All of the other contracts must be consistent with and depend on this contract; these might be collectively referred to as "subsidiary", "auxillary" or "ancillary" contracts.

This contract is most commonly referred to by the industry as a "Host Government Contract" because it is a contract between a Government (on the behalf of the nation and its people) and an oil company or companies (that are being hosted). It is through this contract that the host government legally grants rights to oil companies to conduct "petroleum operations". This contract appears in countries throughout the world under many names:

- Petroleum Contract

- Exploration & Producting Agreement (E&P)

- Exploration & Exploitation Contract

- Concession

- License Agreement

- Petroleum Sharing Agreement (PSA)

- Production Sharing Contract (PSA)

A small minority of countries will not, however, follow this approach to petroleum extraction. They may, instead, manage most of extraction process themselves, therefore removing the need to partner with an IOC and the need for the Host Government Contract. Examples include; Saudi Arabia's National Oil Company Saudi Aramco and Mexico's Pemex.

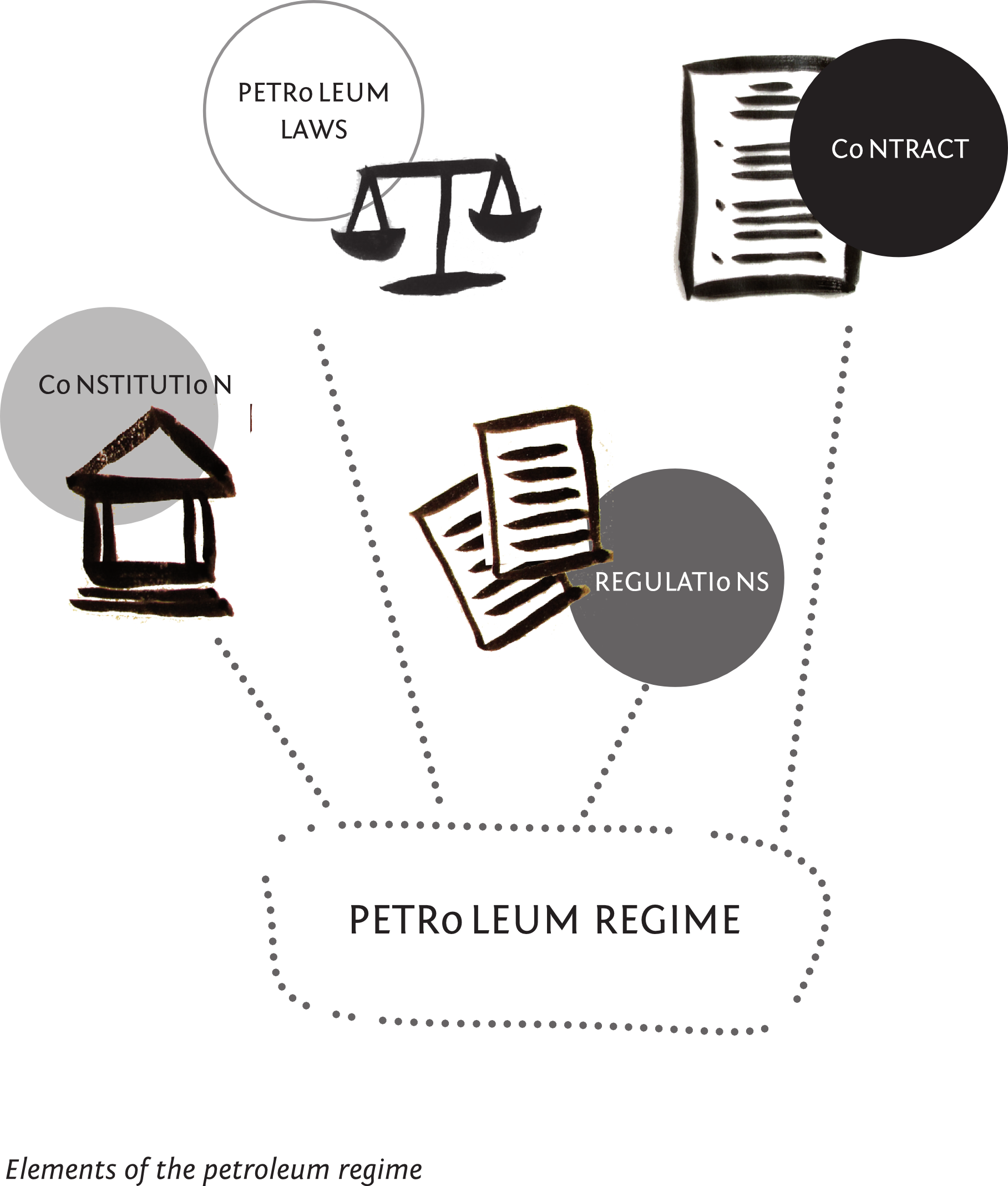

The petroleum regime

You now have a petroleum contract in your hands. Do you have everything you need to understand the relationship between the government and the contractors by just reading through the contract? No.

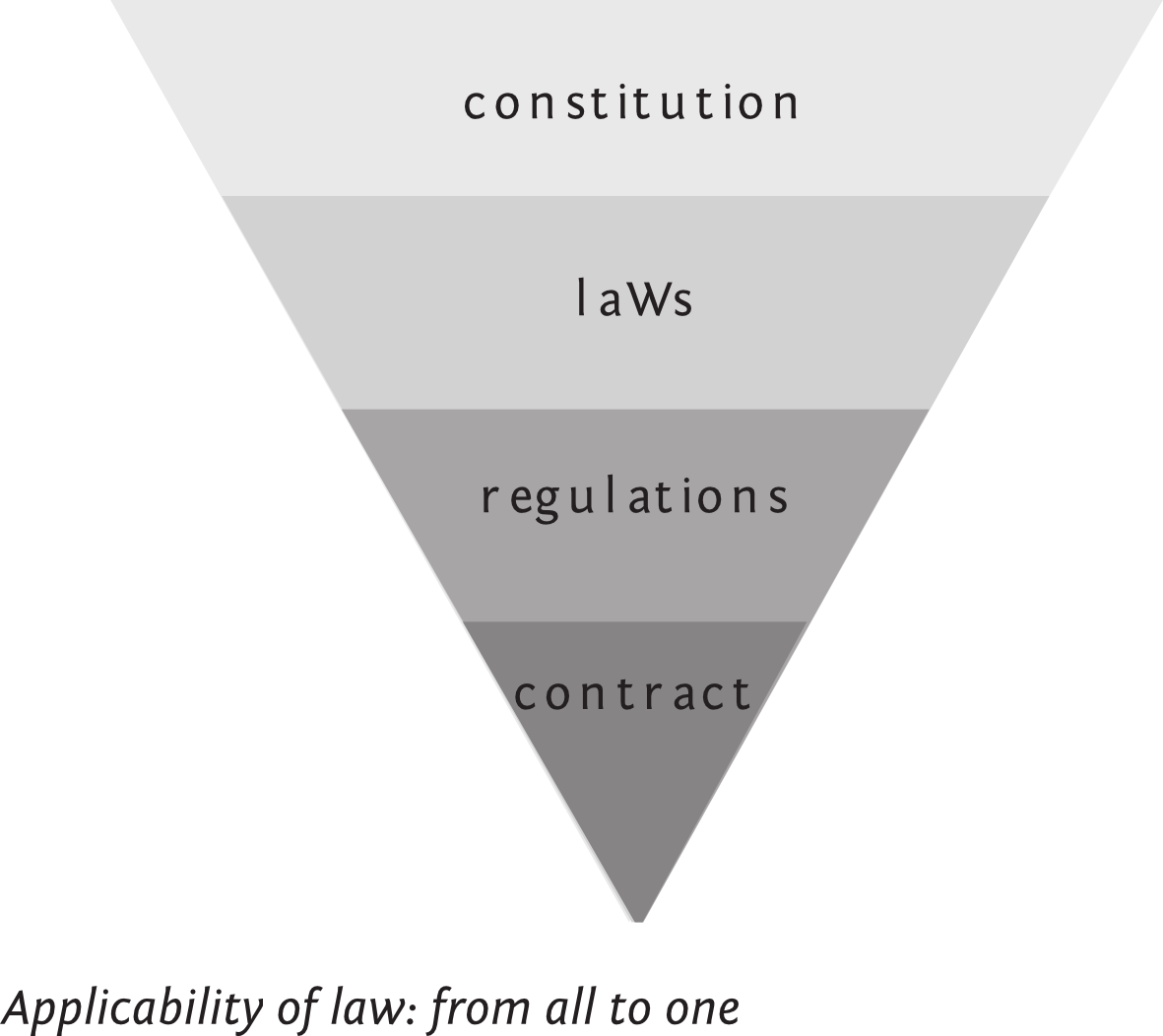

We'll say it once and it will surely be said again: petroleum contracts are one key feature, living in a constellation or web of other laws and regulations above it and many other subcontracts and other ancillary contracts are below it. These will be referred to by the contract but will not be explicitly described, explained or re-written.

This web of laws and regulations relating to petroleum within a particular country is known as a "petroleum regime". The petroleum regime can be best thought of as a hierarchy, starting with the constitution of the relevant country and ending with petroleum contract.

Constitution

The constitution will establish the authority for a government to make and enforce laws. It may also address the ownership of the country's natural resources and, in this case, will typically state that resources are owned by citizens of the nation, or held for their benefit by the current government.

Laws and Regulations

Then comes the petroleum law, which contains specific rules relating to the rights and responsibilities granted in the contract. Other laws will also form an important part of the "petroleum regime" including, for example, environmental laws, health and safety laws, tax laws and labour laws.

EXCERPT from Ghana Model Petroleum Agreement:

10.2 - “The chargeable income of Contractor is determined under section 2 of the Petroleum Income Tax Law …”

Next, there may be petroleum regulations, which are made in accordance with the petroleum law. As we move down the hierarchy from the constitution, to laws, to petroleum regulations, the rules relating to petroleum exploitation will become increasingly detailed and specific.

Contracts

So, the petroleum contract is simply one part of the overall petroleum regime that governs petroleum resources. It is, however, the part that defines the particularities and rights that are essential to any company wanting to explore and extract within that country.

Awarding petroleum contracts

There are two main systems for awarding or winning contracts:

Competitive Bid: Given the value of petroleum today, many countries award contracts by holding a 'bid round'. Here, companies compete against each other by offering the best terms with regards to one or more defined variables to win the contract.

Ad hoc negotiations: Here an investor comes unsolicited and asks for a particular parcel of land and then negotiates a contract directly.

First-come, first-served: Alternatively, there might be an application system and the first company that applies and passes whatever regulatory hurdles the state may have, is then awarded the contract - with some negotiations over the terms of the contract usually involved.

The system for awarding contracts in a country (or different areas within that country) may depend on the current state of its petroleum sector. For example; Is there geological data already available? Is it a known petroleum producing area? Is there infrastructure already in place that could be used for this specific block? Hard to reach area?

EXAMPLE: Peru's legal framework, allows for competitive bidding and Ad hoc. Although the country generally favors competitive bid rounds, if a contractor approaches with an interest in an area not currently under consideration, the country may choose to negotiate terms and award a contract directly.

Negotiations

A country is likely to have a model petroleum contract, in a standard format and with standard clauses that can be any of the types of Host Government Contracts listed in the next section. The extent to which the parties will negotiate or change these clauses and terms will depend upon such issues as; the country's petroleum law, market environment and current political situation. Through the negotiating process, the terms may be negotiated significantly from what was in the original model, or it may be only the numbers of one fiscal term on which the companies were bidding, such as a signature bonus that is filled in.

Following negotiations, what was a government model contract will become a signed contract with a particular company or several companies. With the signing of the contract, the company or companies are legally awarded the exclusive right to explore and produce oil in the contract area.

Types of petroleum contracts

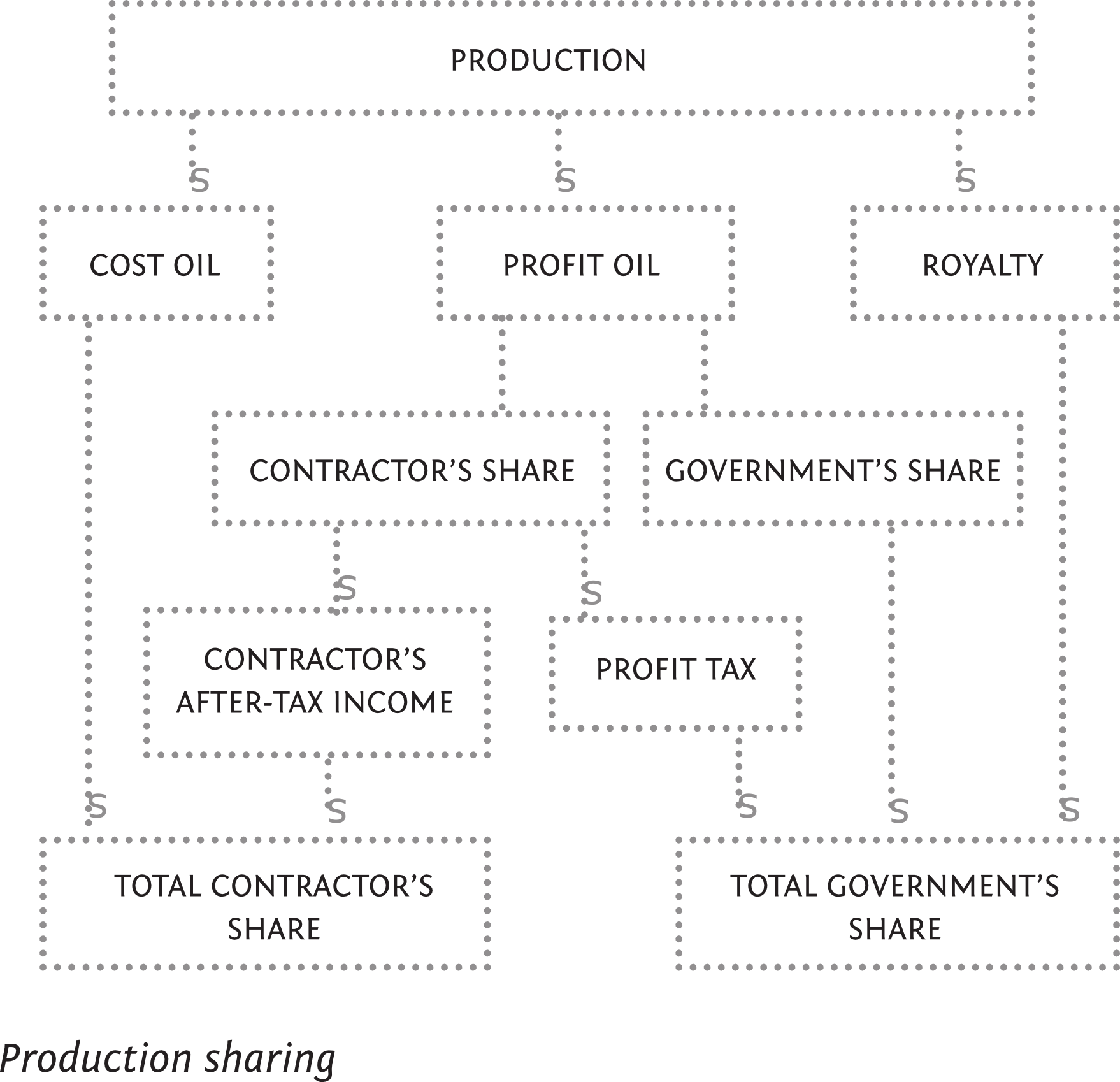

Of these Host Government Contracts, there are three principal types which can be generally characterized as:

- Concession: contractor owns the oil in the ground

- Production Sharing Contract: contractor owns a share of oil once it is out the ground

- Service Contract: contractor receives a fee for getting the oil

Concessions

Concessions are the "original" or oldest form of petroleum contract. First developed during the oil boom in the United States in the 1800s, the idea was then exported to oil producing countries around the world by International Oil Companies (IOC). These contracts are based much more on a "land ownership" concept of oil that is based on the American system of land ownership. In the United States, the landowner, generally speaking, has legal ownership rights of the earth directly below it (sub-surface) and the sky above it.

This would include oil if it was found below a private property owners land. Due to this historical origin, the concession similarly grants an area of land to a company, though typically only the sub-surface rights to the land, and therefore, if that company finds oil below the surface, the company owns that oil. Under the concession the contractor will also have the exclusive right to explore within the concession area.

How then, you may ask, does a country benefits from this form of contract? This usually occurs through taxes and royalties, though a state may also hold shares in the concession through its NOC in a Joint Venture with the contractor.

PSCs and Service Contracts

Production Sharing Contracts or PSCs and Service Contracts are different from concessions, in that they do not give an ownership right to oil in the ground. This also means that the state, being the owner of the resource in the ground, must contract a company to explore on its behalf.

Indonesia can be credited with the innovation of Production Sharing Contracts in 1966. The Indonesian government decided, as a 'nationalistic' move, to move away from concessioning to contracting. This was done so that the state retained ownership of the petroleum produced and only gave the international company the right to explore and take ownership (or legally speaking "title") to it once the petroleum was out of the ground.

This innovation came about at the same time as many petroleum producing countries were gaining their independence and was part of the first wave of the so-called resource nationalism. Another key development during this time was the formation of OPEC (Organisation of Petroleum Exporting Countries) that led to further "re-balancing" of government-company relationships.

Under a Service Contract, title does not transfer at all. Unlike a PSC, where the oil company is entitled to a share of any petroleum produced, under a Service Contract, the oil company is just paid a fee.

Joint Ventures and other combinations

Another type of arrangement that is sometimes considered to be a fourth type of petroleum contract is the Joint Venture. This involves the state, through a national oil company, entering a partnership and working together with an oil company or companies. In this arrangement, it is the joint venture itself that is awarded rights to explore, develop, produce and sell petroleum.

In reality it is rare to find any contract that fits entirely into one of the descriptions given above and is more likely to take elements from each.

Accessing contracts from the outside

The creation and execution of the petroleum laws, model contracts, and especially the negotiation of a signed or executed contract, all are primarily driven by the executive branch of government. This will typically be the Ministry running the petroleum sector and perhaps some other ministries with relevant expertise such as the Ministry of Finance.

Those outside of this 'inner circle', even in other government departments, have historically found petroleum contracts shrouded in secrecy. As a result, the people that are interested, influenced, and affected by these industries, whether in producing or consuming countries often feel left out, in the dark, wondering where the money went or where the oil comes from and on what terms. And while a country's constitution is public (we hope!) and the laws are too (if sometimes hard to find), petroleum contracts are likely to be not easily accessible even if by law they should be.

The range of potential stakeholders is huge, and their concerns too numerous to list them here. While the majority of oil contracts today speak primarily about the financial and technical aspects of oil extraction, they are increasingly addressing concerns of stakeholders that are not directly parties to the contract but are deeply affected by it. This is further addressed in the section: Economic development.

Our great hope is that the rest of the book, which is devoted to the content of petroleum contracts, will help to empower people to read and understand these multi-billion dollar contracts that fuel our world.

5. Our Family of Contracts

We have selected a "bouquet" of petroleum contracts that are in the public domain to use for illustration purposes throughout the rest of the book. It's time to meet them!

6. The Anatomy of Petroleum Contracts

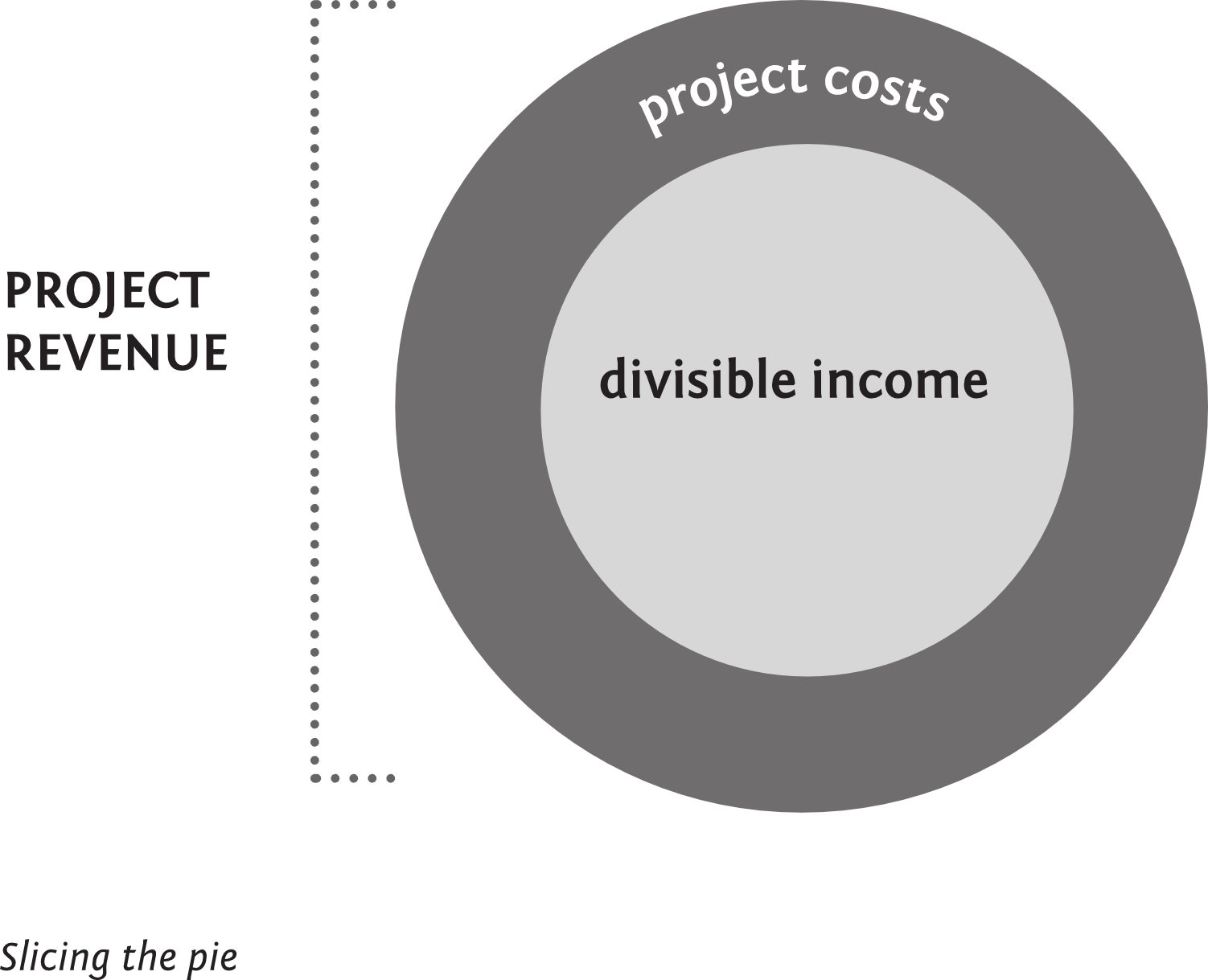

Generally speaking, contracts tend to follow the order in which things would happen in a petroleum project. After the introductions such as the list of terms to be used in the document they move onto exploration, followed by development and appraisal. Up until this point there is no pie to divvy up and so the clauses deal with operational management issues. Once commercial production begins, fiscal terms follow in the contract as in real life. After that come issues such as local content, dispute resolution and confidentiality, and other issues which may be more specific to each contract.

In the very back of the contract, it is common to see the Accounting Procedures for calculating cost oil in the annexes of a contract and various model forms of the ancillary contracts, like a Parent Company Guarantee or the Joint Operating Agreement. These are referred to as "Annexes", "Appendices" or "Addenda" which are all additional documents that are referred to in the contract but for some reason or another, the parties thought the contract would flow better with it as a separate document or the need for the document came after the parties had agreed to the contract.

To get a sense of how generic these contracts can be, let's look at the eight contracts that make up the "family of contracts" we quote from in this book. The table below shows the article numbers dealing with various early stages in the life-cycle of the project and the total number of articles in the main section of the agreement. Iraq doesn't have any clauses relating to exploration because they are dealing with sizable discovered fields.

Chasing issues from clause to clause

But, although there is a certain logical sequence to the contracts, you can often end up chasing a particular issue around the contract, being referred backwards or forwards from one clause to another. If you have a particular question you want to get the answer to, it can feel sometimes like you're playing a game of Snakes and Ladders (or for US readers, Chutes and Ladders!)

Definitions and Block Capitals

Although it seems even more inaccessible than many other parts of the contract, it is often a good idea to get comfortable with Article 1, the list of definitions.This does the legal job of specifying what terms in use throughout the contract actually mean. It can save a lot of time, for example, to realise that the term "Effective Date" in the Indonesian contracts has a specific meaning as defined below:

EXCERPT from Indonesian model contract

1.2.10 - Effective Date means the date of approval of this Contract by the Government of the Republic of Indonesia in accordance with the provisions of the applicable law.

It also helps to know then that this term is now an approved or reserved term which will appear either in capitals ("Effective Date") or sometimes block capitals ("EFFECTIVE DATE") throughout the contract.

Getting Answers from Contracts: Let the chase begin!

Let's say you want to know how long the Iraqi Service Agreement lasts: when does it start and when will it finish. Is it a 10 year contract, 15? 50? One might think this would be a vey straightforward clause in a contract: "this contract lasts 25 years." It is rarely that simple, unfortunately. You have been warned.

To answer any question, you'll want to start at the table of contents (hope that there is one, they are your best friend - otherwise, the chase has just become that much more difficult) and see which heading would seem likely to answer your question. In our case, "Term of Contract" (Article 3) seems the most promising. Flipping to Article 3, we find the following:

EXCERPT from Iraqi Service Agreement

3.1 This Contract shall come into force on the Effective Date.

3.2 The basic term of this Contract ("Term") shall be twenty (20) Years from the Effective Date. This term is extendable pursuant to Article 21 or elsewhere in this Contract.

3.3 No later than one (1) Year prior to this Contract's expiry date, Contractor may submit written request to ROC for an extension of the Term for a maximum period of five (5) Years, subject to newly negotiated terms and conditions.

One part of our question is quite easy: the term of the contract is 20 years.

But when does it start? 3.1 says "on the Effective Date". Because the term is capitalized, we have to go to the definitions and see what it says.

EXCERPT from Iraqi Service Agreement

Definitions section - Effective Date means the date on which all the conditions listed in Article 39 are satisfied.

This defintion shoots us to Article 39:

EXCERPT from Iraqi Service Agreement

39 - This Contract shall enter into force upon (i) it being signed by the Parties, (ii) the Initial Production Rate being agreed on the Parties and (iii) ROC notifying and representing to Contractor in writing that ratification has occurred and the Contract is enforceable accordance with the Law.

Not a very straightforward answer, but an answer nonetheless. Upon these "trigger events" (whenever those may occur) that point will be when the contract will last for 20 years.

Except for the exceptions. 3.2 tells us that the term is extendable pursuant to Article 31. You'll want to flip back to the table of contents to see what this article covers, which is "Force Majeure" which, in summary, is a concept found in many contracts (not just petroleum) that allows the suspension of a contract while so-called unforeseen events or "acts of God" like hurricanes or acts of war allow the contract to be suspended until the event has resolved. So, this is one way in which the contract might be extended. But the last phrase of 3.2, "or elsewhere in this Contract" is where things get really ugly: this clause literally shoots you to the entire contract to hunt and see where else the contract might be extended. Depending on just how precise you need to be with your answer, your task may have just gotten a good bit longer.

If you're staying fairly general, 3.3 tells you that there could be a 5 year extension if the Contractor requests it from the ROC, which you would need to go to the definitions to find out what this is.

EXCERPT from Iraqi Service Agreement

Definitions section - "----" or "ROC" means an Iraqi State oil company operating the Field prior to the Effective Date.

We have our general answer. The contractor will need to go to the State to get 5 more years for a possible total of 25 years.

So in order to understand this short article, we have now been referred to at least 4 other other locations in the document for a fairly general answer and we would need to review the entire document for a specific answer!

This is quite normal. Petroleum contracts are interwoven in this way. You could spend quite a long time following the trail of an issue from one clause to another related clause and it is only with the passage of time that you begin to develop a sense of when it makes sense, for your immediate purpose, to follow the trail and when it is time to stop.

They're Not Perfect

Lastly, although it might be surprising in documents which have been pored over for months and sometimes years by dozens of people, there are sometimes glitches. Some examples:

The version of Ghana's agreement with Tullow, which is countersigned by both parties, goes straight from Article 23 to Article 25 in the Table of Contents.

Brazil's concession agreement confuses "national" with "natural" in the table of contents, summarising the contents of Clause Eleven as "Supply to Natural Market". This may reflect the fact that the English is a translation and that Brazil specifies the official language of contracts as Portuguese. These complex negotiations are often happening through a language barrier, which can give rise to errors in translation.

Finally, even if you are only interested in one agreement, it is worth spending the time to read several others to begin to get a sense for what is common in petroleum contracts and what might be of more specific interest in the one you are looking at. The extra confidence and understanding you gain will more than repay the time and effort.

7. The Stars of the Show

If the petroleum contract is the script, the stars of the show are those entities that sign the contract and agree to be bound by its term and conditions. They are what we call the "parties" to the contract. The parties are usually the host government line ministry or its state/ national oil company (NOC) on the one hand, and an IOC or a group of IOCs, on the other. IOCs may be referred to as the contractor, the licensee or the concessionaire depending upon the type of the petroleum contract signed. Frequently more than one IOC is a party to the petroleum contract. Such group of IOCs is called a "consortium". Each of the companies are an individual party to the contract, but are treated as one entity and are collectively called the "contractor", the "licensee" or the "concessionaire". From the state's perspective, if the IOCs together fail to fulfill their obligations then they are all at fault. In legal language the IOCs are said to have "joint and several liability" for the performance of the contractor's obligations under the contract.

NOC's multiple roles

In addition to the NOC being party to the petroleum contract on behalf of the state, the script may require the NOC to play another role as well. The host country and the IOC may agree on some form of state participation in the project. In this event, the NOC will be a party to the petroleum contract as well as the representative of the state granting rights to the other parties. Sometimes an affiliate of the NOC is established for the purpose of representing the NOC in the direct operations of the project. Such state participation may be both one of the fiscal tools available to the state as discussed in the section: "'The Money'" and a means to promote broader national development goals as discussed in the section: "Economic Development".

Other actors

An IOC will often participate in a petroleum contract through an affiliate company rather than the ultimate parent company for various reasons such as tax optimization, project financing structuring, foreign investment protection regime structuring or local law requirements. This makes the IOC the "parent" company. Such an affiliate will be incorporated in another jurisdiction than the parent company or the country that is the party to the petroleum contract.

For example, BP PLC as the parent company sits at the top of the BP group of companies. BP PLC is the entity that people have in mind when BP is referred to in the media. BP's interests in various countries are held by affiliate companies such as BP Exploration Angola, BP Egypt Company, BP Energy Brazil and so on. These affiliate companies will be the parties to the petroleum contracts in the relevant countries, not BP the parent company.

Often the only asset of this affiliate company is the field as determined in the petroleum contract to which it is a party. This exposes the country, and therefore the other parties to the contract, to a lot of risk. This is because there are no available financial resources on this company's balance sheet, only oil in the ground to cover any costs. In order to mitigate this risk the state will often require a company within the BP family and with more assets and financial strength (a "bigger balance sheet") to guarantee that the affiliate company will perform its obligations. If the affiliate fails to perform its financial obligations under the petroleum contract the state can require the parent company to step in to fulfill its affiliate's obligations.

The plot - sneak preview

The chapter, "The Anatomy of Petroleum Contracts" sets out the main clauses contained in most petroleum contracts and the other chapters in this book talk in some detail about the the main rights and obligations of the parties. Petroleum contracts will often set out a provision that captures the fundamental grant of rights to the parties as well as the assumption of obligations by the parties. This provision provides the key grant of rights that underlies the entire performance of the contract. An example is given below:

EXCERPT from the Azerbaijan Agreement:

2.1 Grant of Exclusive Right. SOCAR hereby grants to Contractor the sole and exclusive right to conduct Petroleum Operations within and with respect to the Contract Area in accordance with the terms of this Contract and during the term hereof. .....

This grant of right is the main purpose of the petroleum contract. All other rights and obligations are subordinate to it. The clause gives the contractor the right to conduct the components of Petroleum Operations, which are: exploration, appraisal, development, extraction, production, stabilisation, treatment, stimulation, injection, gathering, storage, building rail or roads for loading facilities, building connecting entry point to rail network or to existing pipelines, handling, lifting, transporting petroleum to the delivery point and marketing of petroleum from, and abandonment operations with respect to a contract area.

This grant of rights may be mirrored by a similar statement of obligations. An example is given below:

EXCERPT from the Brazil Model Agreement:

13.1 - "During the effective period of this Agreement and according to its terms and conditions, the Concessionaire shall have, except as contemplated in paragraph 2.6, the exclusive right to perform the Operations in the Concession Area, for this purpose being obliged to, at its own account and risk, make all investments and bear all necessary expenses, to supply all necessary equipment, machines, personnel, service and proper technology and to assume and respond for losses and damages caused, directly or indirectly, by the Operations and their performance, regardless of pre-existing fault, before the ANP, the Federal Government and third-parties, according to paragraphs 2.2, 2.3 and other applicable provisions of this Agreement."

This clause sets out an obligation on the concessionaire to make investments, bear all costs, and provide all necessary equipments, personnel, technology required for the conducting of petroleum operations.

Contracts also include provisions on rights and obligations of host governments. After all, they are a party to the contract, too. An example showing the rights of the host government is shown below:

EXCERPT from the Turkmenistan Model Production Sharing Agreement for Petroleum Exploration and Production in Turkmenistan of 1997:

Article 7

(a) full and complete access to the Contract Area and the right to inspect all assets, records and data owned or maintained by Contractor;

(b) the right to receive and retain copies of all manuals and technical specifications, design documents, drawings, construction records, data, programs and reports;

(c) the right to audit Contractor’s accounts;

(d) the right to receive share of Petroleum.

The same contract also puts a number of obligations on the host government, such as for them to grant all necessary permits and licenses for conducting petroleum operations and open bank accounts, provide entry and work permits for employees, provide permits for importing equipment and materials, provide access to pipelines, prevent hindering the conducting of operations, etc.

The contracts will lay out a decision making process that will be used throughout the life of the contract . This enables both the government and the contractor to fulfill their respective obligations. This is essentially a series of proposals (by the contractor) and approvals (by the state) as events unfold.

Three basic mechanisms are used:

- Yearly work programs

- Plans for the petroleum project phase

- Committees make decisions and the Operator carries them out

The chapters that follow explain all of these in much more detail. The next chapter describes the decisions to be made in each phase of the petroleum project. The next describes who does commitee decision making process. The last describes how the operator carries these out.

Shifts in power and nationalisation

It is worth noting, before we dive into the details, that this is a markedly different relationship between governments and contractors than it was a hundred years ago and it is continuing to evolve. When the oil industry began there were not provisions that allowed the state to share in the decision-making process in agreements. The international companies enjoyed almost complete operational control and made all decisions about how and when to explore, develop and produce oil under concession contacts. But as states began to assert their right to ownership and control of their natural resources, contracts began to include clauses stipulating joint decision making processes. The contract governance issue is generally about how, by whom and what type of project decisions are made and the control tools the host governments or their NOCs have to supervise and check a proper implementation of the contract and have a vote in key operational and other project decisions.

This is a key theme that has come up a number of times in this book: contracts reflect changing times in the bargaining power and the desires of countries. These profoundly important and often deeply political issues of global magnitude manifest themselves in what might otherwise look like a mundane paperwork generating clause in a petroleum contract. In fact, these clauses are part of the fundamental re-shifting in the balance of power--or at least the attempt to. Some of these dynamics are described in the chapters that follow to help give context to these contract clauses.

Currently, there is tension between states wishing to assert their sovereignty over natural resources and companies wishing to maintain control over the operations. The result, then, is that most contracts signed today represent a compromise. They specify joint management structures and procedures. From the state's point of view, one of the advantages of such joint decision-making mechanisms is to increase its management control over petroleum operations by the host government. From the company's view, this management control can decrease efficiency, increase costs and delay profits. But it can also facilitate better relationships with the state over time.

But just because a state has a NOC or has set up a joint management committee, a more robust and equal decision making process is not guaranteed. Countries without NOCs or management committees can exercise management control and have discussions with IOCs and be just as effective at shaping their petroleum sector by having the skills, knowledge and laws to effect these goals. This section does not deal with these systems in much detail since the focus is on what contracts do say, and many of them spend a good deal of their text on these issues.

8. The Roles They Play

What IOCs must do, when, where, how, and at what cost, constitute one of the the fundamental areas in petroleum contracts. To address these issues, petroleum contracts include important clauses related to:

- the definition of an area where exploration and production will be conducted

- the surrendering of unused parts of such area back to the government

- work and financial committments during each phases of petroleum operations

- evaluation of a petroleum finding and development of the field

- annual work programmes and budgets

- data and reports to be provided to the government to inform it and facilitate it in the decision-making process

- ...and many more

Where: Contract (Concession) Area or Block

The size and definition of the contract, or "concession", area for the potential exploration activity which a government makes available to oil companies is of crucial importance in many respects. One of the important reasons is that contractual rights, as granted to an oil company under the petroleum contract is limited to the contract area. This means that whatever you agree upon in the contract, is only applicable in the contract area defined in the contract- nowhere else.

Another important reason is that the determination of size may affect the likelihood that the IOC will make a commercial discovery within the specified area. The smaller the size of the contract area, the higher the chance that it will be on the same geological oil field, or reservoir, as another contract area. This can lead to complications, as the two parties then have to work together, usually through creating a unitisation agreement, to extract the petroleum in the most efficient way.

Some countries use standard size of acreage in awarding contracts (e.g. US, UK, Norway, Brazil, etc.). Most of these countries usually use a gridding system based on geographical minutes. This system allows the contract (concession) area to be accurately defined by reference to coordinates as defined by the Greenwich Meridian Line. Unlike the countries with predetermined size of contract area/acreage, the size of the contract area is subject to negotiations and agreement in other countries. For instance, the Trinidad and Tobago Deep Onshore Model Production Sharing Contract of 2005 serves an example for the latter option. The clause 3 of the model contract ("Contract Area") stipulates the following general characteristics:

EXCERPT from the Trinidad and Tobago Deep Onshore Model Production Sharing Contract of 2005:

"3.1 - The Contract Area as of the Effective Date of the Contract comprises a total area of approximately --------------------- (---,---) hectares, as described in Annex A attached hereto and delineated in the map which forms part thereof."

Under this clause, the size and map of the Contract Area is negotiated and agreed between the parties and attached to the contract. In addition to such clauses, the petroleum contracts tend to explicitly exclude the rights of oil companies to any other natural resources or aquatic resources in the contract area except for the right to explore, develop and produce hydrocarbons.

The size of the contract area may impact what happens in it. The larger the contract area is, the more likely there will be many activities going on it.

When: Overview

Petroleum contracts generally divide petroleum operations into three periods – exploration, development and production phases through various clauses, such as, "Exploration Period, Development Period and Production Period" or variety of other languages. Typically, each of these phases have different legal, operational and commercial frameworks and as such, the various parties in the contract have to carry out different obligations at specified times throughout the project life cycle.

The first part, the exploration phase is a bit unique. This is the one where the parties will specify in some detail the work programs to be carried out in each exploration year. This is because exploration activities are the only ones that can be planned and predicted to a certain degree of accuracy at the time of negotiating and signing the agreement- as mentioned earlier, at the point of signing the contract neither party can be sure that anything further than the initial exploration phase will actually happen.

In the diagram above, you will see that the most explanation is given for the exploration phase. That is because there is often more written about it than any other phase in the contract itself.

However, the yearly activities to be conducted later, such as phases of appraisal, development, production and abandonment will not be specifically planned, except at a very general level, in the contracts. Why? Because you do not know if you'll ever get past the exploration phase, but you're crossing your fingers all the same.

For the appraisal phase, questions such as; "What is the most efficient and sensible approach?" and "How many appraisal wells need to be drilled?" cannot be answered when the contract is signed since we do not yet know whether there will be anything to appraise at all. Contract details concerning the development or later phases are even more speculative; the parties couldn't possibly know how many wells, platforms, and what type would be needed without knowing what is in the ground. But they do create processes for what they hope will result: oil production.

What happens during the Exploration Period

Host governments have an interest in expediting the rate of exploration and thorough and rapid exploration of the contract area and acreage. From this perspective, there may arise a difference of opinion between the government and IOCs. For example, a petroleum company, when acquiring exploration rights, aims to retain maximum freedom of action in rate and extent of exploration, minimum of obligation in terms of incurring expenditures or carrying out exploration work. They are also interested in preserving greater freedom to determine its priorities among the areas in which it holds exploration rights in different parts of the world. Due to these reasons, host countries create mechanisms to strike a proper balance between the interests of oil companies and the energy policy of the country. The mechanisms which host countries incorporate in agreements are designed to ensure that oil companies acquiring exploration rights are deterred from sitting on these areas. They want companies to diligently to carry out exploration, to incur the expenditures necessary for this purpose and to relinquish areas progressively until the entire area would be relinquished if the agreed level of exploration activity was not maintained or if at the end of the stipulated exploration period no commercial discovery is made. These mechanisms include (but not limited to) the following issues in the petroleum industry:

- Time limits for exploration

- Relinquishment requirements

- Minimum work and expenditure obligations

- Approval of annual exploration work programs and work program budgets

- Progressive area fees or rentals (discussed in the fiscal section of this book)

- Supervision of exploration work by the government or NOC.

The exploration period normally starts from the date when the contract become binding on the parties and continues for a number of years, for example, three (3) or more years with the possibility of further extension for an additional period of 1 to 3 years. The length of the initial exploration period should depend on the size and nature of the contract area. The government shall be weary that the length of the term should be sufficient to carry out an efficient and adequate exploration program, but not so long as to permit the contractor to be inactive.

Minimum Work Obligations in Exploration Phase

Governments generally seek to obtain specific minimum work commitments for each year of the initial exploration period with detailed descriptions of the geological and geophysical work to be carried out in each year. In countries where there have been no previous discoveries and where the information available is limited, it can be quite difficult to obtain specific drilling commitments during the initial exploration period. In effect, seismic work during the initial exploration stage may constitute the only work commitments for oil companies. In these situations, the company will commit to a minimum geophysical and geological work program (as well as minimum financial commitments to carry out such work programs), save for drilling an exploration well before there is enough positive geological certainty about the field.

In countries with rich geological prospectivity and previous petroleum discoveries, the situation is different as far as the scope of work commitments in the exploration stage is concerned. The core of most work programmes is the obligation to "shoot", or record, a specific number of line kilometres of seismic and to drill exploration or wildcat wells. The determination of work programme or expenditure obligation is usually subject to intense negotiations as this phase constitutes major risks for oil companies before making a commercial discovery. The specification of these terms depends on the circumstances of a particular case and petroleum prospectivity of the country. The minimum exploration work program and expenditure and drilling obligations are key points in petroleum contracts since a failure in exploration terminates the contract for the oil company and it is not compensated for the reconnaissance, drilling and appraisal costs and hence such costs constitute a sunk cost. Typically, IOCs insist on lesser work program and flexible expenditure obligation with carry forward provision.

The Equatorial Guinea Model Production Sharing Agreement may serve an example for the scope of work obligations to be carried out by the oil company at the exploration phase. Pursuant to Article 3 of this Anogla contract ("Exploration Work Obligations") shall do following minimum work program at its own risk and cost:

EXCERPT from the Equatorial Guinea Model Production Sharing Agreement:

"(a) obtain... all existing 2D and 3D seismic data and Well data at a purchase price of [___] Dollars ($[___]) and obtain from GESeis all existing 3D seismic and seabed logging data...and the Contractor shall undertake to interpret such information;

(b) reprocess [____] kilometers of existing 2D seismic data and [___] kilometers of 3D seismic data; and

(c)acquire [____] kilometers of new 3D seismic data.

During the Second Exploration Sub-Period, the Contractor must drill a minimum of [___] Exploration Well[s] to a minimum depth of [_____] meters below the seabed. The minimum expenditure for this period shall be [___] Dollars ($[____])."

Under the outlined model, the contractor shall not only acquire and interpret certain seismic required to drill a number of exploration wells and invest the agreed amount of required financial commitments.Such financial commitments are usually equivalent in value to the estimated costs of the minimum work programs which are stipulated in the agreement for each year. In the event of the stipulation of the defined amount of financial commitment, the contractor must satisfy both the minimum work commitment and the minimum financial commitment for a particular year. Thus, if the minimum financial commitment has been met but the minimum work program has not been completed, the contractor must nevertheless complete that work program. Conversely, if the work program is completed but the financial commitment has not been fully expended, the contractor will be required to conduct additional exploration activities up to the balance of the financial commitment.

Relinquishment

One of the techniques for ensuring that the oil company carries out exploration expeditiously, and does not "lock up" the contract area, is to require mandatory relinquishment, meaning surrendering the unused part of the contract area or block back to the government. To encourage rapid and through exploration, petroleum agreements normally contain provisions for voluntary and mandatory relinquishment or surrender of acreage or contract area clauses such as "Relinquishment of the Contract Area". The aim of such a clause in petroleum contracts is to ensure that the IOC surrenders the unused parts of the contract area or block back to the government on a timely basis. The Indian Model Production Sharing Contract for Seventh Offer of Blocks as of 2007 serve an example for general relinquishment obligations under petroleum contracts (Article 4):

EXCERPT from the Indian Model Production Sharing Contract for Seventh Offer of Blocks, 2007:

4 - "If at the end of the first Exploration Phase, the Contractor elects, pursuant to Article 3.4, to continue Exploration Operations in the Contract Area in the second Exploration Phase, the Contractor shall retain up to sixty per cent (60%) of the original Contract Area, including any Development and Discovery Area in not more than three (3) areas of simple geometrical shapes and relinquish the balance of the Contract Area prior to the commencement of the second Exploration Phase. Notwithstanding the provision of this Article 4.1, in the event the Development Areas and Discovery Areas exceed sixty per cent (60%) of the original Contract Area, the Contractor shall be entitled to retain the extent of Development Areas and Discovery Areas.

At the end of the second Exploration Phase, the Contractor shall retain only Development Areas and Discovery Areas."

Such provisions prevent petroleum companies from “locking up” large contract areas which they do not use for exploration work.

In addition to mandatory relinquishment clauses, petroleum contracts may also include voluntary relinquishment mechanisms whereas the oil company surrenders a part of the contract area back to the government even though the contract does not require it to do so. Under voluntary mechanism, the contractor will usually have the opportunity to surrender voluntarily any or all of the area at any time subject only to fulfilling the work commitments and serving an advance notice to the government.

There is a considerable variation in relinquishment obligations in world petroleum contracts. The time periods for relinquishment should be viewed in the context of the size of the contract area, the overall length of the exploration period and the nature of the exploration area itself. Generally, such obligations are more strict in petroleum producing countries with proven reserves than in countries with a lower potential for oil production. The areas to be relinquished may constitute between 50% and 75% of the original contract area. Relinquishment is usually made in two or three steps, say, 25% each two year.

Discovery, Appraisal, Declaration of Commerciality and Development

After finding a petroleum discovery by a petroleum company, am appraisal period will typically commence. This period allows the contractor to determine the commerciality of the discovery and to determine a development process if it thinks it will be worth producing. Petroleum contracts usually address this critical issue through "Decision of Commerciality", "Discovery", "Discovery, Development and Production", or similar clauses. While some major petroleum producing countries (e.g. China, Indonesia, Brazil etc.) require a say of the NOC in determining the commerciality of a petroleum finding, others leave this issue entirely to the discretion of petroleum companies (e.g. Azerbaijan, India, Tanzania).

Petroleum contracts usually provide that in the event of a petroleum finding petroleum company shall notify the ministry or NOC of such a discovery and its commerciality within certain period of time. In addition, petroleum company has to submit all supporting information and data analysis. The Production Sharing Contract between The Government of the United Republic of Tanzania, and (hereinafter referred to as the “Government”), The Tanzania Petroleum Development Corporation and ABC Oil Company as of 2004 provides for the following mechanism (Article 8: Discovery and Development) in the event where a discovery is made by the contractor:

EXCERPT from the Production Sharing Contract between The Government of the United Republic of Tanzania:

"(a) If Crude Oil is discovered in the Contract Area, Contractor will, within thirty days from the date on which evaluated test results relating to the discovery are submitted to TPDC, inform TPDC by notice in writing whether or not the discovery is in the opinion of Contractor of potential commercial interest.

(b) If Contractor informs TPDC that, in its opinion, utilizing good oilfield practice, the discovery is of eventual commercial interest and TPDC agrees with such determination, then the Minister shall be advised to agree to allow the Contractor to retain the Discovery Block for the duration of the Exploration Licence and any renewal thereof..."